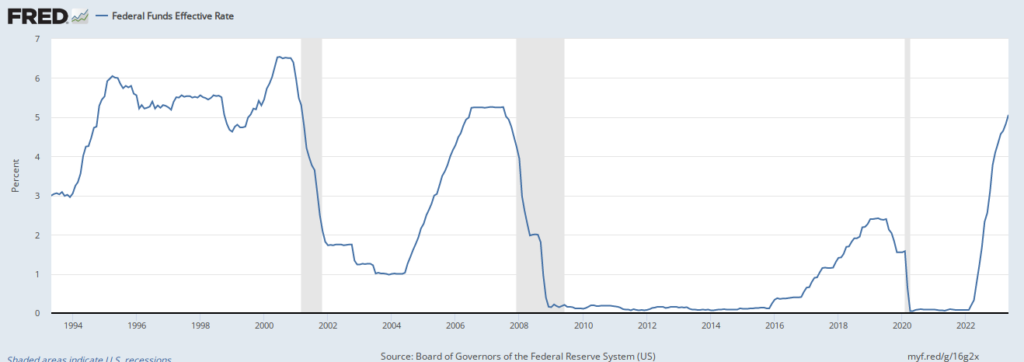

The Federal Reserve has raised rates 5% since March of 2022, finally pausing in June 2023 Federal Open Market Committee meeting. This has been a consistent cycle with increases at each meeting including two 50bps and four 75bps hikes.

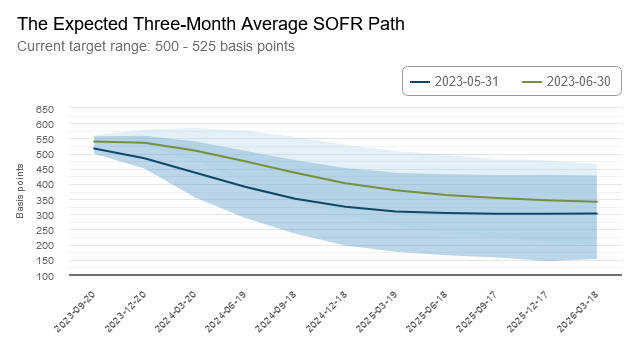

The main question for everyone is which direction the Fed will go next. FOMC officials continue to expect further rate hikes, signaling the potential for two more rate hikes this year. Market participants, on the other hand, are looking for rate cuts to begin potentially this year:

What is the case for lower rates going forward?

Rapid rate increases alongside yield curve inversions typically are followed by a recession and periods of rising unemployment that exert downward pressure on inflation. It always wise to consider market predictions, but unemployment has remained low to date. Long lags of monetary policy may be playing a role here.

The next concerning factor is the regional banking crisis this spring. Further instability here could reduce bank lending. You could argue the Fed may view reduced lending as another way to cool the economy, but the experience of what happens when banking issues become systemic should bias them towards easing.

Commercial real estate remains challenged as pandemic work shifts have caused office occupancy to fall. Some high-profile CRE loans have already gone into default with many notes becoming due over the coming year at these elevated rate levels. It will be important to monitor the scale of losses here, particularly those borne by the banking sector.

Could the Fed hike again this year?

While inflation has moderated, it remains high relative to the Fed’s 2% target:

The Fed will also be looking at pockets of strength in the economy. Public excitement about Artificial Intelligence has boosted a rally in the equity markets during 2023 thus far. A manufacturing supercycle may be taking off in America. Both items could exert sizable upward pressure on spending and prices.

NGPD is elevated and predicted to remain so. It is unclear how closely FOMC members look at this metric, but it is signaling a hot economy.

My Verdict:

The Fed needs to have humility here. Rate increases have been rapid, and we do not yet know the impact of them.

The housing market is deeply unhealthy. Over 90% of American mortgages are fixed, often at levels much beneath the current market rates near 7%. This disincentivizes current homeowners from selling and may lengthen the long lags in monetary policy transmission.

Weakness that would cause the Fed to cut rates is in front of us, it has not happened already. There is a real danger that the market is making the opposite mistake of the 2010s. Then, rate hikes were always around the corner. Now, it is the cuts that keep getting predicted. The Fed will be looking backwards at the real time data.

A pause is appropriate, but I do not think it is a pivot. I think the market has not been serious enough about rates being higher for longer. Further exuberance in equities will only strengthen their case.